Representative Payee

AccuFund Onsite

A Robust, Flexible Tool for Tracking Funds and Paying Bills on Behalf of Clients

Agencies that serve as fiscal guardians for clients or patients who are unable to manage their own finances (e.g., the elderly, mentally handicapped, and drug-dependent) can often get bogged down by complex manual processes.

AccuFund’s Representative Payee system enables tremendous time savings, by relieving the detail-intensive burden of coordinating accounting for individual clients.

The system tracks funds received from the Social Security Administration and other agencies; pays rent, utility bills, and other living expenses; and can maintain funds in one shared bank account to simplify reconciliation.

Enjoy the Convenience of Consolidated Client Accounts

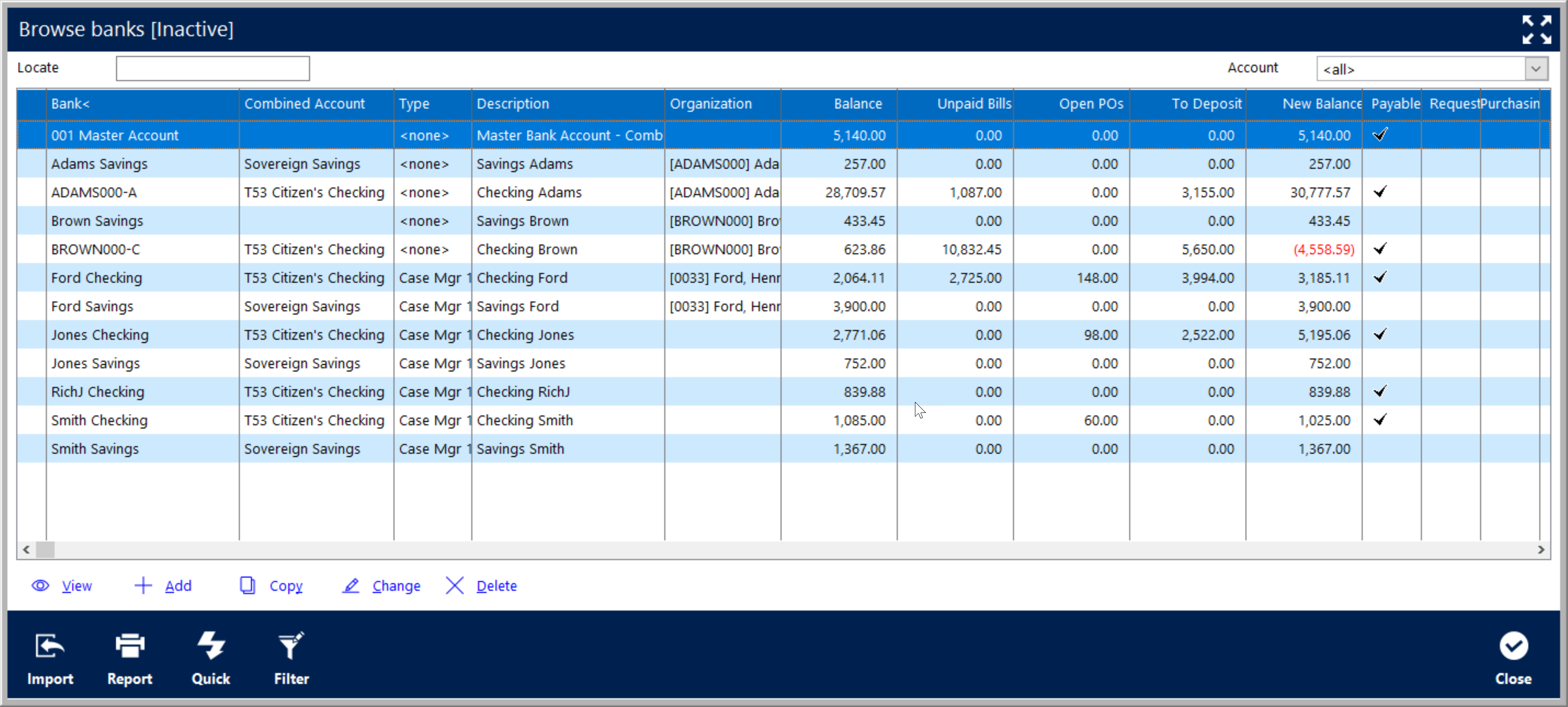

With AccuFund’s Representative Payee system, your custodial checking accounts are administered in a single location. You can set up individual accounts for each client, consolidate them all, or create consolidated accounts for different groups of clients.

Consolidated accounts minimize costs, increase interest-earning power, and are easily managed using virtual bank registers.

No matter how you set up your accounts, AccuFund’s Representative Payee offers these conveniences:

- The ability to accommodate pay cards and direct deposit/electronic funds transfer (EFT)

- A budgeting tool that limits expenses to pre authorized amounts

- Positive Pay, an automatic fraud detection system that verifies checks presented for payment against a list of checks issued

Smoothly Handle Large Amounts of Data

Because all financial data, bank information, and your client database are secured in one location, information is fully integrated and can be easily located and retrieved.

Client reports can be generated based on several criteria, including case managers. You can also drill down from a client to specific vendors.

Core Components

The Representative Payee system works directly with the following core components of the AccuFund Accounting Suite:

- General Ledger

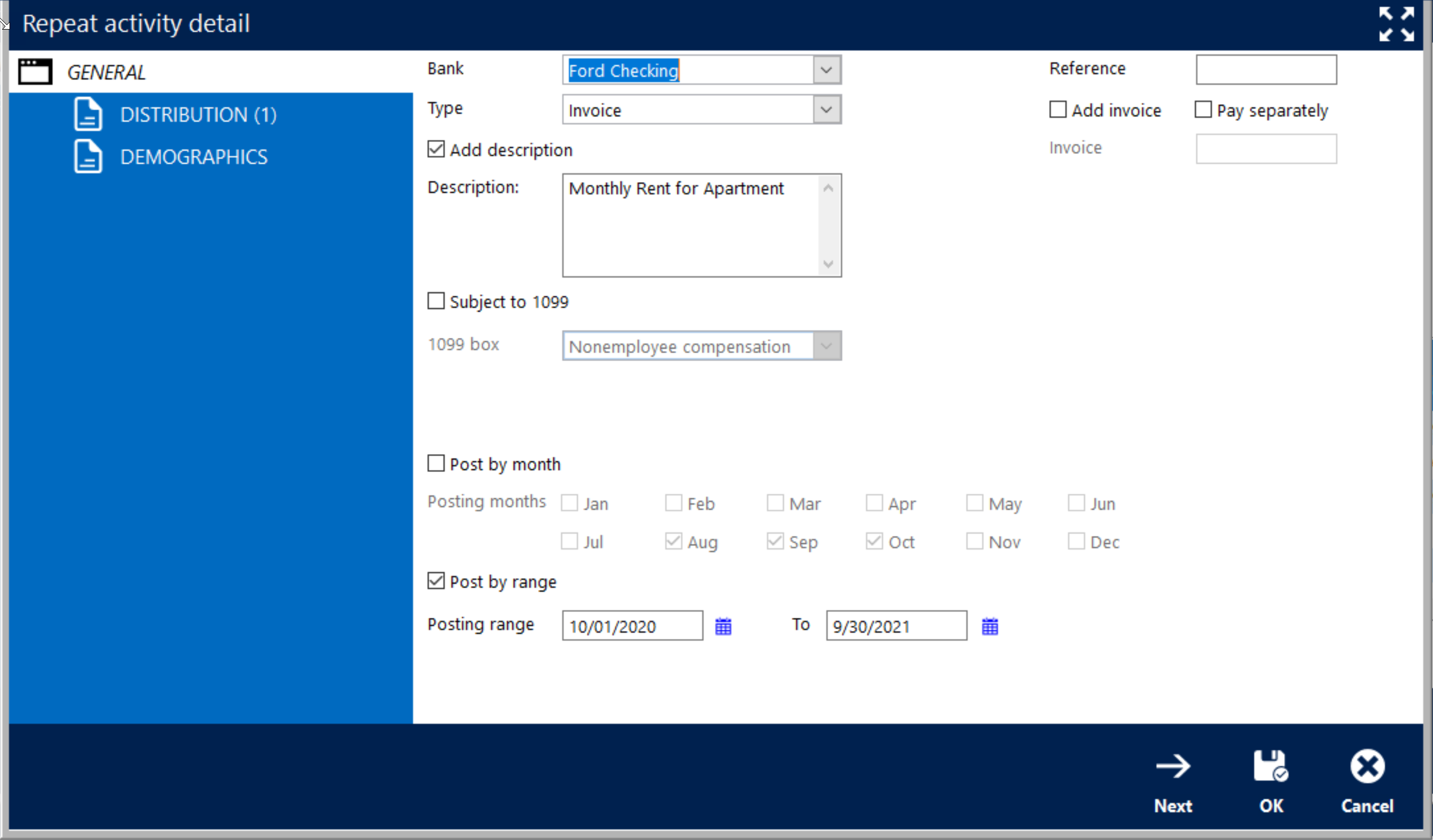

All transactions processed in the Representative Payee system are posted to the General Ledger in real time, so you can generate up-to-the-minute financial statements for each client. General Ledger supports multiple transaction types, such as actual, budget, memo entries, requested, budget revisions, and closing entries. It also lets you indicate the bank account from which a client’s bills are paid. - Accounts Payable

Accounts Payable provides support for multiple checking accounts and full check production in a single run. Invoices are tracked for each checking account, which makes it easier to forecast cash requirements. Recurring payments, like monthly rent, can be set up for automatic posting in the system. You can also enter invoices into Accounts Payable as soon as they’re received, knowing that the system will automatically track due dates for cash management and check processing. When marking bills for payment, you can quickly verify account balances. Invoice may be distributed to multiple checking accounts using stored percentage distribution tables, and you can set alerts for duplicate invoice numbers. - Cash Receipts

AccuFund’s Cash Receipts module records funds received from SSA, SSI, and other sources. These funds can be imported directly from your combined bank account and posted to specific client balances. - Bank Reconciliation

With the Bank Reconciliation module, you can fully reconcile each checking account from bank to register and from register to General Ledger. Accounts Payable checks, cash deposits, adjustments, and account transfers can all be combined, enabling you to maintain a complete history of all client-related items. The register screen lets you view information related to any individual bank account and mark individual checks, deposits, or cash adjustments to update balances by transaction type. Service charges and interest paid are also entered here.

Add-On Modules

For added convenience, the AccuFund Representative Payee module can also be integrated with the following add-on modules:

- Accounts Receivable

Enables billing and collections to customers/agencies for funds owed. - Allocation Workbench

Provides a convenient way to make complex allocations to client data, such as interest or fee allocations based on client balances over a date range. This module also enables API integrations with banks and other web-based applications. - Client Accounting

Tracks client demographics, document management, change histories, and client queries. - Fixed Assets

Monitors client assets, such as vehicles, property, etc - Requisitions Management

Enables payment workflow approval process for caseworkers and others.

Let's Get Started

AccuFund supports your mission with a full suite of financial management applications for nonprofit and government organizations. To learn more and arrange a demo, contact AccuFund at 877-872-2228 or